The Beginner’s Guide to Investing in Cryptocurrency: Understanding the Basics

Investing in cryptocurrency can be a daunting task for beginners, but it doesn’t have to be. By understanding the basics of how the market works, you can make informed decisions and potentially profit from your investments.

First, research the different types of cryptocurrencies and their underlying technology. Bitcoin, for example, is the largest and most well-known cryptocurrency, but there are many others with different features and potential uses.

Next, consider the volatility of the market and the potential for fraud or hacking. It is important to only invest what you can afford to lose and to store your assets in a secure wallet. Crypto scam recovery refers to the process of recovering lost funds from a scam. This can include contacting the authorities and working with them to track down the scammers, or hiring a professional recovery service to help retrieve stolen funds.

It’s important to be vigilant and thoroughly research any investment opportunities before handing over any funds. Finally, stay informed about developments in the industry and the overall market conditions, as these can greatly impact the value of your investments.

The Advantages and Disadvantages of Investing in Cryptocurrency

However, like any investment, it is important to weigh the potential advantage and disadvantage before diving in.

Advantage:

High potential returns: The value of some cryptocurrencies, such as Bitcoin, has increased dramatically in recent years. This has led to many investors seeing substantial returns on their investments.

Decentralization: Cryptocurrencies are decentralized and not controlled by any government or institution, which can provide a level of security and autonomy for investors.

Accessibility: With the rise of various cryptocurrency exchanges and fund services, it is now easier than ever for individuals to invest in cryptocurrencies.

It is also important to use only reputable exchanges and fund recovery services to minimize the risk of fraud and to protect yourself in case of loss or theft.

Disadvantage:

Volatility: The value of cryptocurrencies can be highly volatile, which can lead to substantial losses for investors.

Risk of fraud: Cryptocurrency markets are not regulated, which means that there is a higher risk of fraud or hacking. It’s important to be vigilant about security and only invest in reputable exchanges and fund services.

Lack of understanding: Cryptocurrency is a relatively new and complex technology, and not everyone may fully understand it

Investing in cryptocurrency can be a high-risk, high-reward endeavor, and it’s important to be fully informed and aware of the potential risks and rewards before making a decision. It is also important to diversify your investment portfolio to minimize the risk and to invest only what you can afford to lose.

Investing in Cryptocurrency Through a 401k

Investing in cryptocurrency through a 401k plan is currently not a widely available option, as most 401k plans only allow investments in traditional assets such as stocks, bonds, and mutual funds. However, some companies have started offering cryptocurrency investment options in their 401k plans, but they are still rare and not yet widely adopted.

Before investing through cryptocurrency through a 401K you need to totally know about how to invest in cryptocurrency .One way to invest in cryptocurrency is by purchasing it directly on a cryptocurrency exchange, such as Coinbase or Binance. Once your account is set up, you can purchase cryptocurrency using fiat currency or another cryptocurrency.

Before making a decision, it is important to thoroughly research the different options available and understand the risks associated with investing in cryptocurrency. It is also recommended to diversify your investments and only invest what you can afford to lose.

It is also important to note that investing in cryptocurrency is highly speculative and there are many risks involved. The value of cryptocurrency can be extremely volatile, and there is a risk of hacking or fraud on exchanges.

Additionally, the regulatory environment for cryptocurrency is constantly changing, which can also add to the uncertainty. Before investing, it’s important to do your due diligence and understand the risks involved. It’s also worth consulting with a financial advisor to make sure that investing in cryptocurrency is appropriate for your personal financial situation and risk tolerance.

Predictions for Cryptocurrency Investment in the Upcoming Years

The future of cryptocurrency investing is highly speculative and uncertain. However, it is likely that the use and adoption of cryptocurrencies will continue to grow in the coming years. As more businesses and individuals begin to accept and use digital currencies, demand for them will likely increase. Additionally, the increasing use of blockchain technology in various industries could also drive demand for cryptocurrencies.

Another trend to watch is the increasing institutional involvement in the cryptocurrency market. In recent years, we have seen major investment firms, such as Fidelity and Goldman Sachs, enter the space. This trend is likely to continue, as institutional investors seek to gain exposure to the potential growth of digital assets.

However, it is important to note that the cryptocurrency market is highly volatile and risky. Prices can fluctuate wildly in short periods of time, and many digital currencies have no underlying value or utility. As such, it is important to do your research and invest only what you can afford to lose.

In summary, the future of cryptocurrency investing is uncertain, but it is likely that the use and adoption of digital currencies will continue to grow in the coming years. As more businesses and individuals accept and use digital currencies, demand for them will likely increase. With the increasing institutional involvement in the cryptocurrency market, it’s becoming more stable, but it’s important to be aware of the high volatility and risks inherent in the market.

Unveiling the Truth Behind Blood Diamonds

Unveiling the Truth Behind Blood Diamonds  Unveiling the Finest Title Loans Against Jewellery: Melbourne’s Premier Gold Buyers

Unveiling the Finest Title Loans Against Jewellery: Melbourne’s Premier Gold Buyers  The Beauty and Brilliance of Lab Diamond Rings: A Guide to Claws and Settings

The Beauty and Brilliance of Lab Diamond Rings: A Guide to Claws and Settings  Linux Dedicated Servers: Unlocking Performance and Customization

Linux Dedicated Servers: Unlocking Performance and Customization  ECommerce Web Development and the Integration of Emerging Technologies

ECommerce Web Development and the Integration of Emerging Technologies  Why Politics and War Tops the List of Online Political Strategy Games

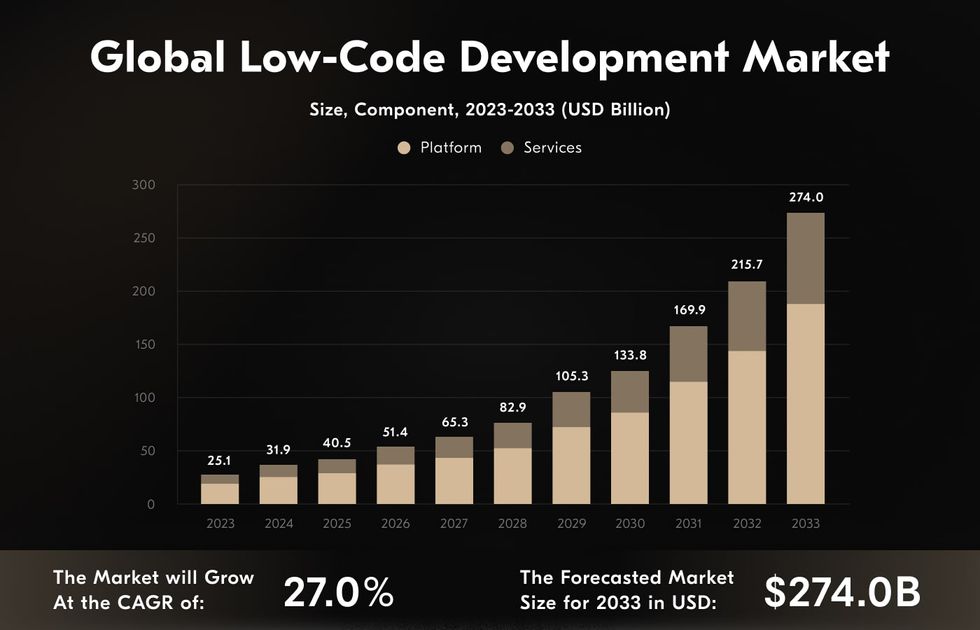

Why Politics and War Tops the List of Online Political Strategy Games  Scaling New Heights: How Low-Code Streamlines App Scalability and Performance

Scaling New Heights: How Low-Code Streamlines App Scalability and Performance  Why Live Action Explainer Videos are the Future of Marketing

Why Live Action Explainer Videos are the Future of Marketing  Web Software Development: Building Robust and Scalable Applications

Web Software Development: Building Robust and Scalable Applications